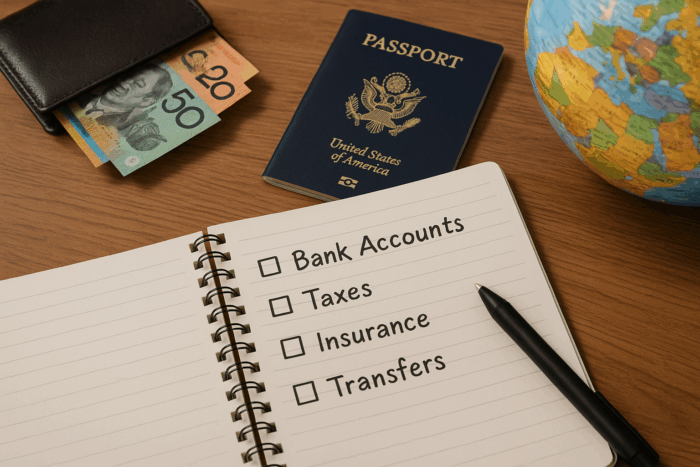

There are several money tasks to complete before leaving your country, including bank accounts, credit cards, taxes, insurance, and international transfers. If that sounds overwhelming, you’re not alone.

Plenty of Australians dream about starting fresh in a new country, but dread all the money admin that comes with it. And since a solid plan now means zero financial surprises later, these tips will help you leave Australia with your finances in order and your sanity intact.

In this guide, we’ll walk you through bank accounts, insurance, and other essential money tasks. Once you’re done reading, you’ll feel confident knowing your money is handled overseas.

Let’s get into it.

Financial Planning Before Moving Overseas

Getting your finances sorted before you leave Australia is half the battle. Without it, things can unravel quickly. You might face frozen accounts, unexpected fees, or trouble accessing your money once you’re overseas.

We know it sounds dramatic, but it happens far too often. That’s why a bit of planning now will save you from those panic moments down the track.

Here’s where to start:

Close or Transfer Your Bank Accounts

Before anything else, decide if you want to keep your home country bank account open or close it entirely.

This decision might seem like a small detail, but it can snowball fast. Some banks charge dormant fees when accounts sit unused for months (and yes, we’ve seen frozen account chaos before). What’s worse, some banks might even lock your funds without warning when they don’t hear from you.

To stay ahead of this, transfer your money to an overseas bank account early. So you’re not scrambling while juggling moving boxes.

Credit Cards and Foreign Transaction Fees

If you’re wondering whether your current credit card will even work overseas. The short answer is yes, but there’s a catch.

Many credit cards charge international transaction fees every time you pay in foreign currency. It might look small per swipe, but these fees stack up quickly. So look for cards that offer zero foreign fees to make living overseas a bit easier on the wallet.

How to Handle Transaction Fees When Living Overseas

When living overseas, the best move is opening accounts that waive foreign transaction fees, which can save you hundreds over time.

Through our practical knowledge of helping expats relocate, we’ve seen how quickly regular fees drain budgets. Your bank takes a cut, the foreign bank takes a cut, and poor exchange rates chip away at what’s left.

One simple fix is to compare fee structures between your bank, debit card, and credit card before you leave. You’ll likely find that online banks offer better exchange rates and lower fees.

Pro Tip: Let your bank know you’re moving overseas. Doing this upfront helps prevent your account from being flagged or frozen for suspicious activity.

Taxes and Paperwork for Your Life Overseas

Moving overseas comes with its own share of paperwork. Taxes, nationality rules, and important documents all need attention before you get ready to leave.

Let’s break it down.

Capital Gains Tax and What It Means for You

In simple terms, selling an asset for more than you paid creates a taxable profit. This is called capital gains tax.

If you’re planning to sell property or investments before moving overseas, you may need to pay tax on the profit. What you owe depends on how long you’ve held the asset and your residency status for tax purposes.

A quick chat with a tax professional before any major sales helps you avoid overpaying.

Dual Nationality and Your Finances

Holding dual nationality comes with perks, but it also adds complexity to your finances.

Since many countries tax citizens on worldwide income, you might owe money to two countries at once. Luckily, tax treaties exist to prevent double taxation. These agreements decide who gets to tax what, so you don’t pay twice on the same income.

Important Documents You Can’t Forget

Your important documents also need attention before you leave. Passport, visa, tax returns, bank statements, and investment records should all be kept in one place so you can grab them quickly when needed.

Beyond physical copies, keep digital backups in the cloud for access anywhere. Based on our firsthand experience, these backups have helped many expats replace lost or stolen documents without the usual panic.

Some visas also require proof of your financial situation, so have these ready.

Pro Tip: Make a checklist of your important documents and tick them off as you go. It keeps you organised and ensures nothing gets left behind.

Protecting Your Money Overseas

Protecting your money overseas means getting proper insurance, comparing transfer services, and opening a local bank account. Without these in place, medical emergencies, sneaky fees, and bad exchange rates can drain your savings fast. But with some planning, you can hold onto more of what you’ve earned.

Below are the main areas you should look out for.

Why Travel Insurance Counts When Working Overseas

Travel insurance protects you from costly emergencies when working abroad. The reason it’s so important is that you’re exposed to more risks over a longer stay, and standard policies aren’t built to cover that.

That’s all fine until something unexpected happens. Take health emergencies, for example: a surprise hospital bill, and medical evacuation alone can cost tens of thousands of dollars.

Expat-specific policies are built for exactly this, covering longer stays, work activities, and bigger medical bills. Local insurance in your new country is another option once you’re settled.

Sending Money Overseas Without Losing It to Fees

Here’s something most people don’t realize: Sending money overseas can get costly, and fees and poor exchange rates will eat into your transfer fast.

A lot of this comes down to how you send the money. Traditional banks are often the worst offenders. They charge high fees and offer poor exchange rates, so what you send and what actually arrives can look quite different.

However, services like Wise or Remitly are good alternatives. They typically offer better rates and lower fees, so running a quick comparison before sending large sums could save you a decent chunk of money.

Setting Up a Local Bank Account in Your New Country

A local bank account should be near the top of your to-do list when you arrive. It lets you receive your salary directly, pay bills easily, and skip foreign transaction fees.

Most banks won’t let you walk in empty-handed, though. Expect them to ask for your passport, visa, and proof of address since they’re legally required to verify your identity before opening any account.

Every bank handles things differently, though, and some are friendlier to newcomers than others. A little research before you arrive helps you avoid any surprises.

Your Quick Money Checklist Before You Go

An international move brings a stack of financial tasks, and it’s easy to feel weighed down by them. That pressure grows when you realise that without proper planning, you risk frozen accounts, unexpected fees, and financial stress abroad. The good news is that with the right steps, you can leave with your finances fully under control.

This guide covers bank accounts, credit cards, taxes, insurance, and international transfers. Each task allows you to avoid costly mistakes and land in your new country ready to hit the ground running.

Ready to make your move stress-free? Explore our website for more relocation tips and resources to guide you to start a new chapter abroad.